NRI Income Tax Return Filing in India

Taxation for NRI Individuals

NRI Income tax return in India

The fundamental backbone of the Indian economic structure thrives on the taxation extracted from its populace. Under the Indian Income Tax Act of 1961, Non-Resident Indian (NRI) taxation ensues for those garnering income beyond their native borders. The delineation of income tax regulations and advantages availed to them starkly deviates from those bestowed upon resident Indian counterparts.

In this article you will get to know everything about NRI income Tax Return Filing in India.

- NRI Income Tax Return Filing in India

- Taxation for NRI Individuals

- Mandatory Income Tax Return Filing

- What is Income Earned or Accrued in India?

- Deadline for Income Tax Return Filing

- Advance Tax Obligations for NRIs

- Taxation of Rental Income for NRIs

- Compliance Procedures for Remittance to NRIs

- Taxation of Other Income Sources

- Distinct Tax Provisions for Investment Income

- Special Provisions for Capital Gains

- Seeking Tax Consultation

- Deductions and Exemptions for NRIs

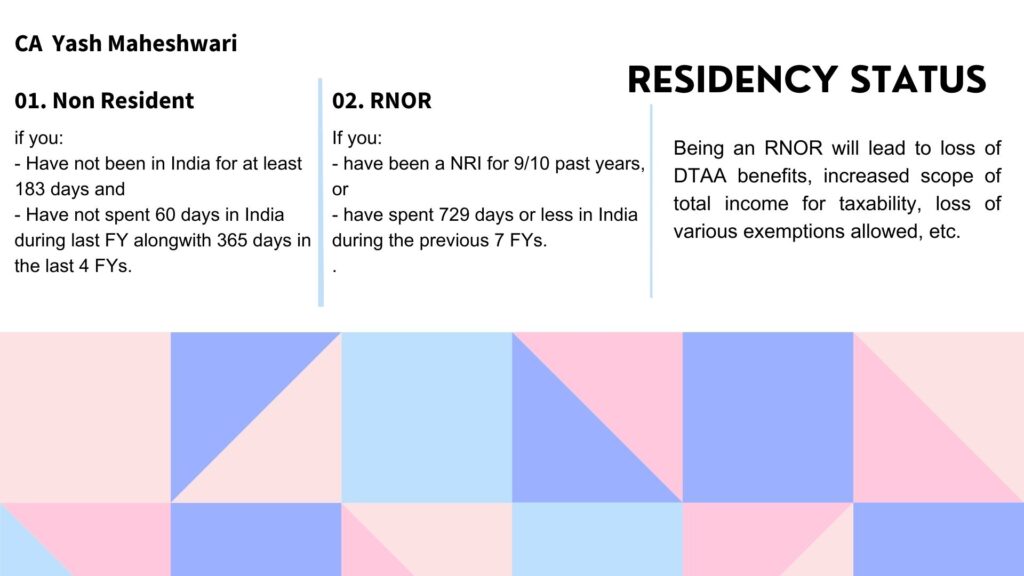

Determining Residential Status

Ascertainment of one’s residential status for a fiscal year hinges upon satisfying any of the ensuing conditions:

- Presence within India for 182 days or more during the fiscal year.

- A residence in India for 60 days or more in the preceding year, coupled with a domicile extending 365 days or more within the previous four years.

It merits attention that Indian citizens laboring abroad or crewing Indian vessels are subjected solely to the initial condition, designating residency upon spending a minimum of 182 days within Indian borders.

Similar stipulations apply to Persons of Indian Origin (PIO) journeying to India in the prior year, whose total income (excluding foreign revenue) remains below or equivalent to 15 lakhs. In such cases, the latter condition holds no sway. A PIO is an individual whose lineage traces back to parents or grandparents originating from undivided India. Failure to meet the abovementioned criteria denotes one as a Non-Resident Indian.

Amended Definition of Resident but Not-Ordinary Resident (RNOR)

An individual attains RNOR status for the year upon fulfilling the ensuing criteria:

- Non-residence in India for 9 out of 10 years preceding the antecedent year.

- Residency in India spanning 729 days or less throughout the 7 years preceding the previous fiscal.

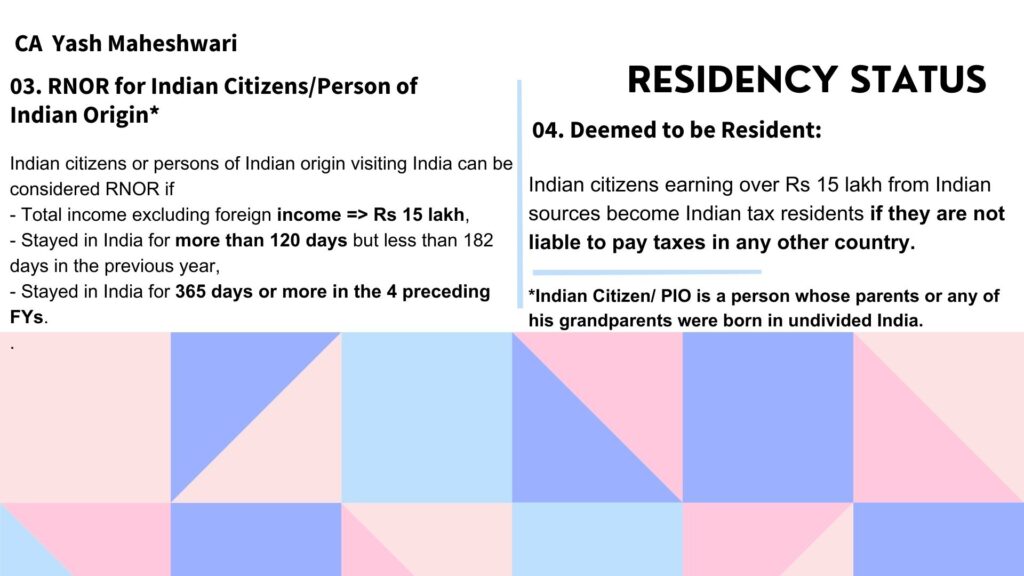

Modification introduced by the Finance Act of 2020 extends the residency purview to include Indian Citizens/Persons of Indian Origin visiting India. Said individuals shall now be conferred RNOR status, subject to the subsequent conditions: - Total income, exclusive of foreign earnings, surpasses Rs 15 lakhs.

- Duration of stay in India exceeds 120 days yet falls short of 182 days in the antecedent year.

- Accumulated stay within India aggregates to 365 days or more during the preceding four years.

Preceding the amendment, such individuals would have been classified as non-residents. Consequently, the aforesaid amendment potentially reclassifies an individual’s residential status as RNOR, thereby jeopardizing the benefits of DTAA, expanding the ambit of taxable total income, and relinquishing various exemptions hitherto sanctioned.

Furthermore, the aforementioned amendment delineates that any individual surpassing 182 days within Indian precincts shall be branded a resident, regardless of previous fiscal year income levels.

Introduction of Deemed Residency Status

Enshrined within the Finance Act of 2020, the notion of ‘Deemed Residency’ posits that Indian Citizens amassing over Rs 15 lakhs from Indian sources shall be deemed residents of India, provided they evade tax liabilities elsewhere. Consequently, such deemed residents are relegated to the RNOR echelon, effective from the fiscal year 2020-21. This legislative tweak aims to ensnare the earnings of Indian citizens evading tax obligations elsewhere.

Special Relief Amidst COVID Lockdown

For the fiscal year 2019-20, individuals landing in India prior to March 22, 2020, and encountering the subsequent predicaments:

- Inability to depart India due to lockdown by March 31, 2020 – absolving the period spanning March 22 to March 31 from consideration.

- Quarantined owing to COVID-19 post-March 1, 2020, and departing on an evacuation flight by March 31, 2020, or remaining stranded – precluding consideration of the quarantine period until March 31.

- Departure on an evacuation flight by March 31, 2020 – negating consideration from March 22 to the departure date.

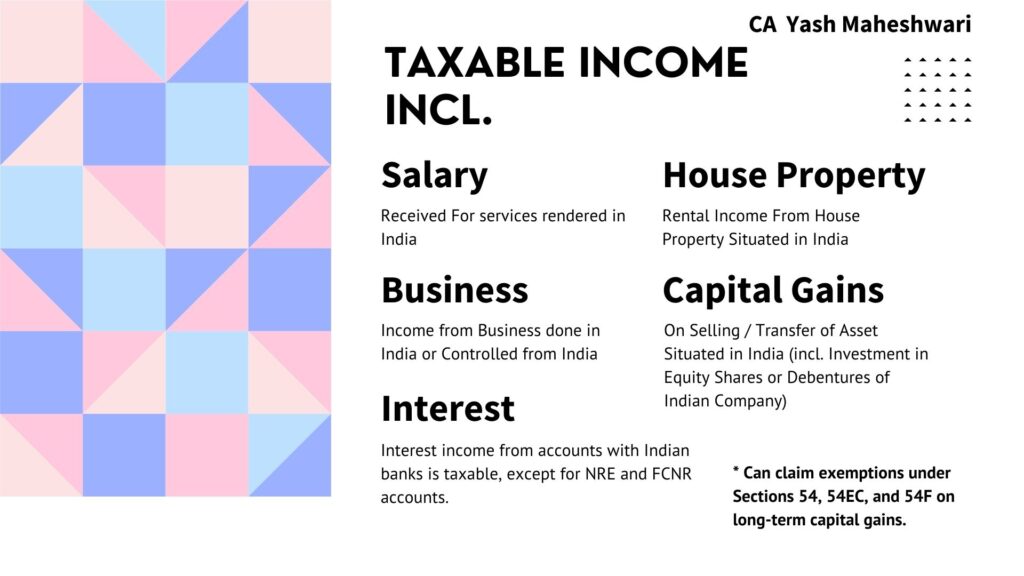

Taxability of Foreign Earned Income

Tax liabilities for an NRI in India are contingent upon their residential status, as delineated above. Residents are subject to taxation on their global earnings, whereas NRIs incur tax liabilities solely on income accrued or garnered within India.

- Examples of taxable income include salary derived from services rendered within India, income from Indian property, capital gains from asset transfer within India, and interest from Indian bank deposits.

- Conversely, income derived abroad eludes Indian taxation.

- Interest accrued on NRE and FCNR accounts remains tax-exempt, while interest from NRO accounts bears taxable implications for NRIs.

Mandatory Income Tax Return Filing

It is imperative for individuals whose income exceeds Rs. 2,50,000 to fulfill the obligation of filing an income tax return in India. This threshold pertains solely to income taxable within India and does not encompass income exempt from taxation in the country. For illustration, let us consider the scenario of Mr. Nayan. Although Mr. Nayan earns Rs. 1 crore outside of India, which remains non-taxable within the Indian jurisdiction, he also generates income from Indian sources such as house property rent, capital gains from Indian assets, and interest on savings accounts or fixed deposits exceeding Rs. 2,50,000. Consequently, he is obligated to file an income tax return within the stipulated deadlines.

Additionally, in situations where tax deducted at source (TDS) has been applied to income such as interest income or capital gains, and there is a desire to claim a refund for the deducted tax, the filing of an income tax return becomes obligatory.

What is Income Earned or Accrued in India?

India follows the “source rule” basis of taxation, i.e., all the income that accrues or arises from or through a source in India is taxable in India. Therefore, identifying the source of Income is of utmost importance.

If it is established that the income has its source in India, whether direct or indirect, such income would become taxable in India. A list of such incomes are:-

- Any salary received in India,

- Any salary received for services rendered in India,

- Rental income (if any) received from a property situated in India,

- Capital gain (if any) arising on account of transfer of property or asset in India

- Any income from deposits in India, such as interest on fixed deposits

- Any interest received on the savings bank account, etc.

1. Income from Salary:

Under the purview of Indian tax laws, salary income of NRIs is subject to taxation under two primary scenarios:

Situation A: Receipt of Salary in India Should an NRI receive salary directly into an Indian account or through a representative in India, it becomes taxable in the country.

Situation B: Income Earned in India Income is deemed ‘earned in India’ if it is generated from services rendered within the territorial boundaries of India. Consequently, NRIs earning salary for services provided in India are liable to taxation.

Taxation is levied according to the applicable slab rate corresponding to the individual’s income bracket.

2. Income from House Property:

Any revenue derived from property situated in India, whether rented or vacant, constitutes taxable income for NRIs. The computation of such income mirrors the methodology employed for resident individuals.

NRIs are entitled to:

- A standard deduction of 30%.

- Deduction of property taxes.

- Benefit from interest deduction on home loans.

- Claim principal repayment under section 80C.

- Reap benefits of stamp duty and registration charges under section 80C.

It’s crucial to note that even if the income is routed to the NRI’s account abroad or NRE account, taxation remains applicable as the income source, i.e., the property, resides within India.

3. Income from Other Sources:

Income originating from Indian sources, such as interest from fixed deposits and savings accounts in Indian banks, is taxable. While interest from NRE and FCNR accounts remains tax-exempt, interest from NRO accounts is fully taxable.

4. Income from Capital Gains:

Proceeds from the transfer of capital assets located in India are subject to taxation. This includes capital gains from investments in shares and securities.

For capital assets like house property, the following taxation applies:

A. Long-term capital gains: TDS of 20%. B. Short-term capital gains: TDS of 30%.

The buyer, irrespective of being an individual, is responsible for deducting tax at source and remitting it to the Government. To fulfill this obligation, the buyer must obtain a Tax Deduction Account Number (TAN) and furnish a TDS certificate accordingly.

Rental Payments to an NRI

- A tenant paying rent to an NRI owner is required to deduct TDS at 30% while making the payment, whether to an Indian account or to an NRI account.

- The TDS deductor has to submit Form 15CA prepared and submit it online to the Income Tax Department.

- In some cases, the tenant is also required to furnish Form 15CB, which is a CA-certified form. Form- 15CB is not required in cases where the remittance is less than Rs.5,00,000 in a year and if the AO orders a lower deduction of TDS or if the transaction falls under Rule 37BB of the Income Tax Act.

Deadline for Income Tax Return Filing

July 31st marks the culmination of the income tax return filing window in India for NRIs, barring any extensions by the government.

Advance Tax Obligations for NRIs

NRIs must remit advance tax if their tax dues surpass Rs 10,000 for a fiscal year, with non-compliance attracting interest under Sections 234B and 234C.

Taxation of Rental Income for NRIs

Rental income from Indian properties attracts taxation for NRIs. Withholding tax, pegged at 30%, is incumbent upon tenants remitting rent. This income may be directed to an Indian or overseas account held by the NRI landlord.

Compliance Procedures for Remittance to NRIs

Form 15CA, necessitated for remittances to Non-Resident Indians, mandates online submission, complemented by Form 15CB in select scenarios. Noteworthy exceptions obviate the requisite for Form 15CB, encompassing remittances below Rs 5,00,000 and instances warranting lower TDS deductions per Section 197.

Taxation of Other Income Sources

Interest income from Indian bank deposits is taxable, barring NRE and FCNR accounts. Business earnings from India-bound operations incur taxation, as do capital gains arising from Indian asset transfers.

Distinct Tax Provisions for Investment Income

Investment income garners taxation at 20% for NRIs, offering relief in exclusive scenarios, including investments in Indian equities, bonds, and government securities. Notably, deductions under Section 80 are precluded.

Special Provisions for Capital Gains

Long-term capital gains from Indian asset transfers entail a 20% tax rate sans indexation benefits or Section 80 deductions. Nevertheless, exemptions under Sections 54, 54EC, and 54F serve as avenues for circumventing capital gains taxation.

Seeking Tax Consultation

Professional tax expertise can streamline income tax compliance and filing for NRIs, with services commencing at Rs 3,100.

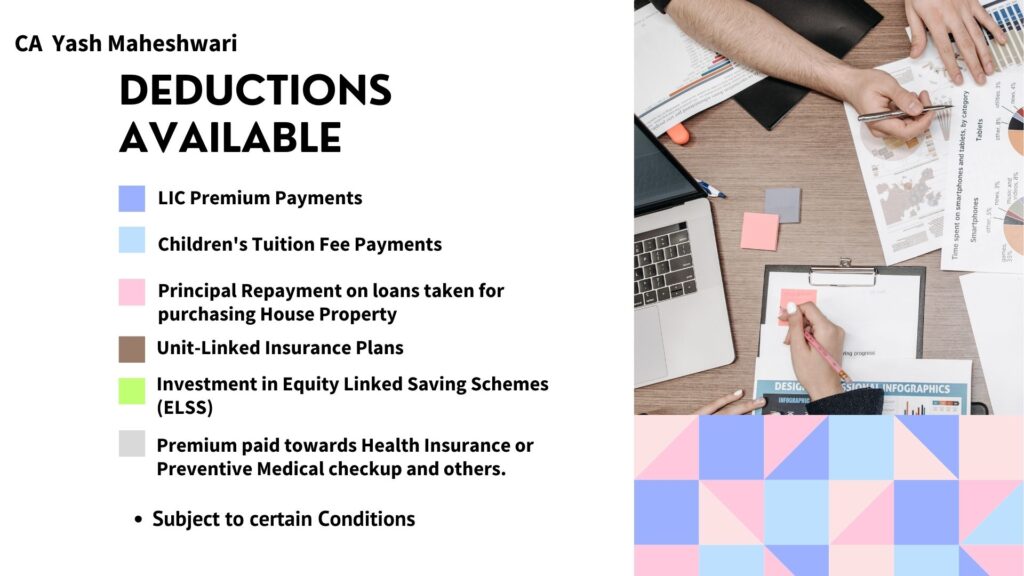

Deductions and Exemptions for NRIs

Analogous to resident counterparts, NRIs avail deductions and exemptions pertinent to Section 80C, encompassing life insurance premiums, tuition fees, and home loan repayments. Furthermore, allowances under Sections 80D, 80E, 80G, and 80TTA augment tax-saving avenues for NRIs.

Deductions Allowed for NRIs:

Section 80C:

- Life Insurance Premium Payments: Deduction available for premiums paid on policies in the NRI’s name, spouse’s name, or children’s name, provided the premium is less than 10% of the sum assured.

- Tuition Fee Payment: Deduction allowed for tuition fees paid to educational institutions in India for the full-time education of the NRI’s children.

- Principal repayment of home loans: NRIs can claim a deduction for principal repayment of home loans taken for purchasing or constructing residential property in India. Stamp duty charges, registration fees, etc., also qualify.

- Unit Linked Insurance Plan (ULIP): Investment in ULIPs qualifies for deduction under Section 80C. Premiums paid for the NRI, spouse, or children are eligible.

- Equity Linked Tax Saving Scheme (ELSS): Investments in ELSS funds are deductible up to Rs. 1.5 lakh per financial year under Section 80C. ELSS funds have a mandatory lock-in period of three years.

Section 80D:

- Health Insurance Premiums: NRIs can claim deduction for premiums paid towards health insurance for themselves, their family, or their parents in India. Different deduction limits apply based on the insured parties’ ages and other factors.

Section 80E:

- Interest on Education Loan: NRIs can claim deduction for interest paid on education loans taken for higher education for themselves, their spouse, their children, or for a student for whom they are the legal guardian. There’s no limit on the amount claimed, and the deduction is available for a maximum of 8 years or until the interest is paid, whichever is earlier.

Section 80G:

- Donations: NRIs can claim deduction for eligible donations made under Section 80G of the Income Tax Act.

Deductions Not Allowed for NRIs:

- Deductions under Section 80CCG, 80DD, 80DDB, and 80U are not available to NRIs.

Exploring Non-Resident Taxation

When it comes to tax liabilities, clarity is crucial, especially for Non-Resident Indians (NRIs). Unlike residents, whose tax obligations are categorized based on age, NRIs face a uniform tax structure, regardless of their age bracket.

Income Tax Slab Rates

The tax slab rates for Non-Resident Individuals can be understood through two regimes: the Old Tax Regime and the New Tax Regime under section 115BAC.

Under the Old Tax Regime:

- Up to ₹2,50,000: Nil

- ₹2,50,001 – ₹5,00,000: 5% above ₹2,50,000

- ₹5,00,001 – ₹10,00,000: ₹12,500 + 20% above ₹5,00,000

- Above ₹10,00,000: ₹1,12,500 + 30% above ₹10,00,000

- Additional slabs exist for incomes between ₹10,00,001 to ₹15,00,000 and above ₹15,00,000 with varying tax rates.

Under the New Tax Regime (default) for FY 2023–24:

- Up to Rs.3 lakh: 0% (Nil)

- Rs. 3 lakh to Rs. 6 lakh: 5%

- Rs. 6 lakh to Rs. 9 lakh: 10%

- Rs. 9 lakh to Rs. 12 lakh: 15%

- Rs. 12 lakh to Rs. 15 lakh: 20%

- Above Rs. 15 lakh: 30%

Surcharge Rates for NRIs

Surcharge rates for NRIs apply on total income exceeding specific thresholds:

- 10% on income between Rs 50 lakhs and Rs 1 crore

- 15% on income between Rs 1 crore and Rs 2 crore

- 25% on income between Rs 2 crore and Rs 5 crore

- 37% on income exceeding Rs 5 crore

It’s important to note that the surcharge is subject to marginal relief and is applicable to NRI incomes.

Rebate under Section 87A

While residents may benefit from a rebate under section 87A, offering a maximum of Rs.12,500, this advantage isn’t extended to Non-Residents.

Basic Exemption Limit Benefits

Despite being Non-Residents, individuals still enjoy the basic exemption limit of Rs. 2,50,000 from their total income. However, if their Indian income comprises solely of short-term or long-term capital gains, this exemption might not be applicable to such gains.

FAQ’s about NRI Income Tax Return Filing in India

Q1. What are the criteria for determining residential status for NRIs in India?

A1. Residential status for NRIs in India is determined based on conditions such as presence in India for 182 days or more during the fiscal year, or residence in India for 60 days or more in the preceding year along with specific domicile criteria.

Q2. What is the significance of RNOR status for NRIs?

A2. RNOR (Resident but Not-Ordinary Resident) status is important for NRIs as it affects their tax liabilities, particularly if they meet specific conditions regarding residency and duration of stay in India.

Q3. How does the Finance Act of 2020 impact the residential status of Indian citizens visiting India?

A3. The Finance Act of 2020 extends the residency criteria for Indian citizens visiting India, potentially affecting their residential status and tax obligations.

Q4. What is the concept of deemed residency under the Finance Act of 2020?

A4. Deemed residency under the Finance Act of 2020 implies that Indian citizens earning over a certain threshold from Indian sources may be considered residents of India for tax purposes.

Q5. What special relief was provided for individuals amidst the COVID-19 lockdown?

A5. Special relief amidst the COVID-19 lockdown included exemptions and considerations for individuals facing difficulties due to travel restrictions and quarantine measures.

Q6. What are the tax implications for NRIs based on their residential status?

A6. Tax liabilities for NRIs in India depend on their residential status, with residents being taxed on global earnings and NRIs being taxed only on income accrued within India.

Q7. What types of income are taxable for NRIs in India?

A7. NRIs in India are taxed on income such as salary earned for services in India, rental income from Indian properties, capital gains from Indian asset transfers, and interest from Indian bank deposits.

Q8. What is the threshold for mandatory income tax return filing for individuals in India?

A8. Individuals in India must file an income tax return if their income exceeds Rs. 2,50,000, considering only income taxable within the country.

Q9. How is income earned or accrued in India determined for taxation purposes?

A9. Income earned or accrued in India is determined based on the source rule, where income originating from or through a source in India is taxable.

Q10. What are the tax implications for NRI salary income?

A10. NRI salary income is subject to taxation if received directly into an Indian account or earned for services rendered within India.

Q11. How is income from house property taxed for NRIs?

A11. Rental income from properties situated in India is taxable for NRIs, with deductions and exemptions available similar to resident individuals.

Q12. Is income from other sources taxable for NRIs?

A12. Yes, income from other sources such as interest from fixed deposits and savings accounts in Indian banks is taxable for NRIs.

Q13. What are the tax implications for capital gains for NRIs?

A13. Capital gains from the transfer of assets located in India are subject to taxation for NRIs, with varying rates depending on the type and duration of asset ownership.

Q14. What is the procedure for deducting TDS on rental payments to NRIs?

A14. Tenants paying rent to NRI landlords are required to deduct TDS at 30% and submit Form 15CA online to the Income Tax Department, with additional requirements in certain cases.

Q15. When is the deadline for income tax return filing for NRIs in India?

A15. The deadline for income tax return filing for NRIs in India is July 31st, unless extended by the government.

Link to Income tax Portal https://eportal.incometax.gov.in/iec/foservices/#/login

CA IN INDORE || CA IN BHOPAL || CA IN PUNE || CA IN SURAT || CA IN MUMBAI || BEST CA FIRM IN INDORE || ITR FILING || NRI INCOME TAX RETURN FILING || ITR FILING IN INDORE || ITR FILING IN BHOPAL || ITR FILING IN PUNE || ITR FILING IN MUMBAI || INCOME TAX CONSULTATION || INCOME TAX CONSULTATION IN INDORE || INCOME TAX CONSULTATION IN BHOPAL || INCOME TAX CONSULTATION IN PUNE || INCOME TAX CONSULTATION IN SURAT || INCOME TAX CONSULTATION IN MUMBAI || GST REGISTRATION || GST CONSULTATION IN INDORE || GST REGISTRATION IN BHOPAL || GST REGISTRATION IN PUNE || GST REGISTRATION IN SURAT || GST REGISTRATION IN MUMBAI || COMPANY REGISTRATION || COMPANY REGISTRATION IN INDORE || COMPANY REGISTRATION IN BHOPAL || COMPANY REGISTRATION IN PUNE || COMPANY REGISTRATION IN SURAT || COMPANY REGISTRATION IN MUMBAI || LLP REGISTRATION || LLP REGISTRATION IN INDORE || LLP REGISTRATION IN BHOPAL || LLP REGISTRATION IN PUNE || LLP REGISTRATION IN SURAT || LLP REGISTRATION IN MUMBAI