Are you feeling overwhelmed by the daunting task of Income Tax Consultation in Surat? Look no further! CA Yash Maheshwari & Co, Best, CA in Pune, Income Tax Return Filing, Company, LLP, GST Registration, Online ITR Filing, Efile is here to simplify the process for you. Whether you’re a salaried individual, a business owner, or a professional, we’ve got you covered. Let’s delve into the ultimate solution for smooth income tax return filing in Surat with our expert assistance.

All you need to know about Income Tax Consultation in Surat

Who Needs to File ITR?

Filing an income tax return isn’t just for the wealthy or business owners. Anyone meeting specific criteria is required to file their ITR. This includes individuals with an income exceeding Rs. 2.5 Lakhs, holders of foreign assets or bank accounts, and beneficiaries of overseas assets.

If Your Income exceed Rs. 2,50,000/-

Meeting Income thresholds is a fundamental requirement for ITR filing. If your income crosses Rs. 2.5 Lakhs, filing becomes mandatory. This ensures you’re compliant with tax regulations and avoids penalties.

Ownership of Foreign Assets?

Owning assets outside India? Then it is mandatory for you to file ITR and also It’s essential to disclose them when filing your ITR. Reporting foreign assets ensures transparency and compliance with tax laws.

Ownership of Foreign Bank Accounts?

Holding a bank account abroad? Then also it becomes mandatory to file your ITR and hence reporting overseas bank accounts is mandatory. Failure to do so can result in penalties and legal complications.

Business Turnover Excedding Rs. 60 Lakhs?

For business owners, turnover exceeding Rs. 60 Lakhs necessitates ITR filing. This includes gross receipts, sales, or turnover from your business operations.

Professional Receipts Exceeding Rs. 10 Lakhs?

Professionals need to file ITR if their total receipts exceed Rs. 10 Lakhs. This encompasses earnings from professional services rendered.

Bank Deposits: Saving and Current account

Large bank deposits are red flags for tax authorities. Deposits exceeding Rs. 50 lakhs in savings accounts or Rs. 1 Crore in current accounts aggregated make ITR filing mandatory.

Foreign Travel Expenses

Spent more than Rs. 2 Lakhs on foreign travel? Then you need to file your ITR and show the legitimate source of Income from which these expenses are being met..

Electricity Bill Expenditure

High electricity bills exceeding Rs. 1 lakh annually then you need to file your ITR.

TDS and TCS

Tax Deducted at Source (TDS) or Tax Collected at Source (TCS) exceeding Rs. 25,000 necessitates ITR filing.

Also to claim the refund of Taxes deducted you need to file your ITR.

Consequences of Not Fiing the ITR when you were Required to

Following are the consequences you might face if you fail to file your ITR when you were required to:

- Taxation at Higher rate

- Prosecution and Fine

- Penalties

- Late filing fees

- Interest

Taxation at Higher Rates

Failure to file your ITR can result in taxation at significantly higher rates, reaching up to 78%. This elevated rate, combined with penalties, can inflate your tax liability to approximately 88%.

Unexplained Bank Credits

Credits in your bank account without proper documentation, such as business turnover, rent from house property, or interest income, can attract this higher tax rate. It’s essential to meticulously analyze all bank statements and accurately report these credits to avoid undue taxation.

Unverified Investments and Expenditures

Investments like fixed deposits, properties, or securities without a legitimate source of income can be considered as undisclosed income. Such undisclosed income is subject to taxation at a higher rate of 78% and similar to above it could result into taxation at the higher rate of 88%.

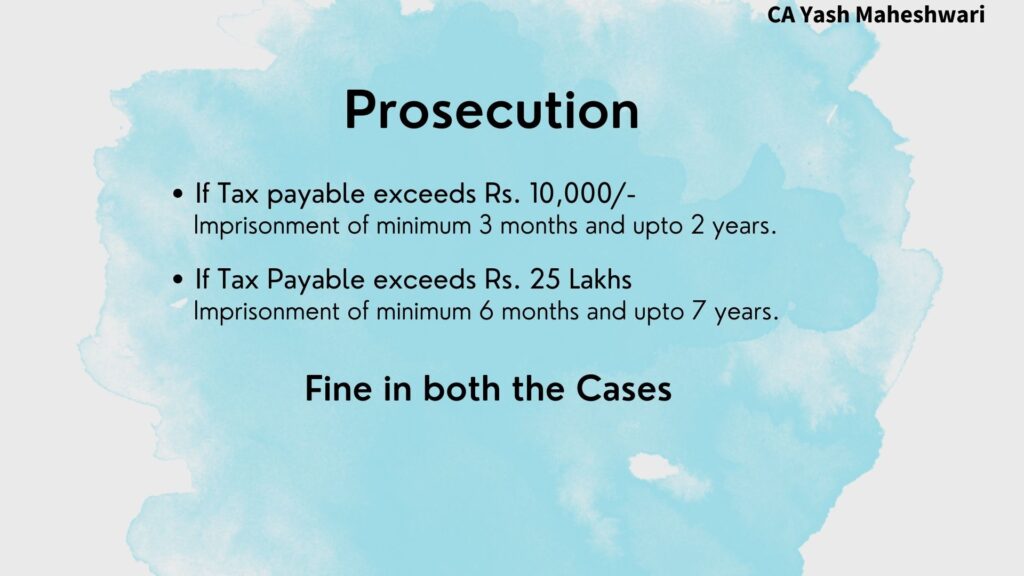

Prosecution and Fine

Non-compliance with Income Tax Return filing in Surat when you were requird to can lead to prosecution and fines, depending on the tax payable amount.

Imprisonment

- For tax payable exceeding Rs. 10,000: Minimum imprisonment of 6 months, up to 3 years.

- For tax payable exceeding Rs. 25 Lakhs: Imprisonment ranging from 6 months to 7 years.

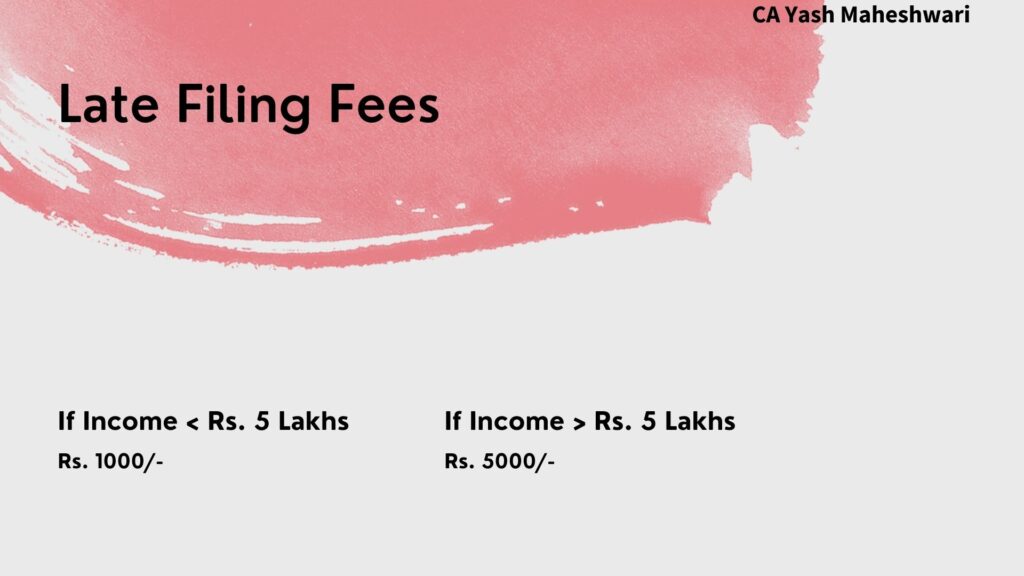

Late Filing Fees

Late submission of ITR incurs additional fees, determined by your income level.

- Income up to Rs. 5 Lakhs: Rs. 1,000 late fee.

- Income exceeding Rs. 5 Lakhs: Rs. 5,000 late fee.

Interest

Interest @1% is continuously levied per month on delay of tax payments.

Income TaxConsultation in Surat

1. Understanding ITR-1: Who Can Use It?

ITR-1, also known as Sahaj, is tailored for individuals with income from salary, one house property, or other sources like interest income. However, if your total income exceeds Rs 50 lakh, or you have income from business/profession, ITR-1 isn’t for you.

2. Who Should Opt for ITR-2 and Why?

ITR-2 is suitable for individuals with income from salary, house property, and other sources, including capital gains and foreign income. If you have income from business/profession or agricultural income exceeding Rs 5,000, ITR-2 is the way to go.

3. Decoding ITR-3: A Guide for Business Owners

If you’re running a business or profession, ITR-3 is your go-to form. It covers income from business/profession, investments in unlisted equity shares, and partnership income.

4. Simplifying ITR-4: Ideal for Small Businesses

ITR-4, also known as Sugam, is perfect for small businesses and professionals opting for presumptive taxation. It’s designed for businesses with turnover up to Rs 2 crore and includes income from business/profession, salary, and one house property.

5. Exploring ITR-5 to ITR-7: Special Cases

ITR-5 is for firms, LLPs, AOPs, BOIs, trusts, and investment funds, while ITR-6 is for companies. ITR-7 is for entities required to furnish returns under specific sections of the Income Tax Act.

6. Benefits of Hiring Professional Tax Consultants

Opting for expert tax consultation ensures accurate Income Tax Return filing in Surat, minimizes errors, and maximizes deductions. Our team at Yash Maheshwari and Co. provides personalized assistance, saving you time and hassle.

7. Common Mistakes to Avoid During Income Tax Return Filing in Surat

Avoid errors like incorrect information, missing deductions, or late filing penalties. With our guidance, you can steer clear of these pitfalls and file your taxes smoothly.

8. Importance of Timely Income Tax Return Filing in Surat

Filing your taxes on time not only avoids penalties but also ensures compliance with tax laws. Stay organized and submit your returns promptly with our assistance.

9. How CA Yash Maheshwari and Co. Can Assist You in Income Tax Return Filing in Surat

At CA Yash Maheshwari and Co., we offer comprehensive tax services, including income tax return filing in Surat, Income tax planning, Income Tax Consultations and representation before tax authorities. Let us handle your tax concerns while you focus on what matters most.

10. Frequently Asked Questions (FAQs)

Income Tax Return Filing in Surat

Common FAQs

Q: For whom Income Tax Return Filing in Surat is mandatory?

Individuals with income above Rs. 2.5 Lakhs, foreign asset holders, and business owners meeting specific criteria are eligible.

Q: What happens if I don’t file my ITR?

Non-filing can lead to penalties, legal actions, and difficulties in financial transactions.

Q: How can I file my ITR?

You can file online via the Income Tax Department’s portal or seek assistance from tax professionals.

Q: Is there a deadline for ITR filing for AY 2024-25?

Yes, the deadline is July 31st 2024. After which Late fees would be leviable

Q: Can I claim deductions while filing ITR?

Yes, deductions for investments, donations, and other eligible expenses can be claimed.

Q: What documents are required for ITR filing?

PAN card, Aadhaar card, bank statements, and investment proofs are essential documents.

Q: Can ITR-1 be used if I have income from multiple house properties?

A: No, ITR-1 is not suitable for individuals with income from more than one house property. You may need to explore other ITR forms based on your specific situation.

Q: Is it mandatory to file income tax returns if my income is below the taxable limit?

A: It’s not mandatory if your income is below the taxable limit. However, other consitions must be kept in mind while deciding whether to file your Income tax Return or not and also filing returns can be beneficial, especially if you want to claim a refund or apply for loans.

Q: Can I file my income tax returns online?

A: Yes, the Income Tax Department offers e-filing facilities for convenient and secure tax filing. You can file your returns online from the comfort of your home or office.

Q: How can I track the status of my income tax refund?

A: You can track the status of your income tax refund online through the Income Tax Department’s website or by contacting their customer service helpline.

Q: What documents do I need to file my income tax returns?

A: Documents like PAN card, Aadhaar card, Form 16, bank statements, investment proofs, and receipts for deductions are essential for filing income tax returns.

In conclusion, navigating the intricacies of Income Tax Return Filing in Surat doesn’t have to be a daunting task. With CA Yash Maheshwari and Co. by your side, you can breeze through the process seamlessly. Reach out to us today and experience hassle-free tax filing like never before!

Official Website of Income Tax India: https://eportal.incometax.gov.in/iec/foservices/#/dashboard/fileIncomeTaxReturn

CA IN INDORE || CA IN BHOPAL || CA IN PUNE || CA IN SURAT || CA IN MUMBAI || BEST CA FIRM IN INDORE || ITR FILING || NRI INCOME TAX RETURN FILING || ITR FILING IN INDORE || ITR FILING IN BHOPAL || ITR FILING IN PUNE || ITR FILING IN MUMBAI || INCOME TAX CONSULTATION || INCOME TAX CONSULTATION IN INDORE || INCOME TAX CONSULTATION IN BHOPAL || INCOME TAX CONSULTATION IN PUNE || INCOME TAX CONSULTATION IN SURAT || INCOME TAX CONSULTATION IN MUMBAI || GST REGISTRATION || GST CONSULTATION IN INDORE || GST REGISTRATION IN BHOPAL || GST REGISTRATION IN PUNE || GST REGISTRATION IN SURAT || GST REGISTRATION IN MUMBAI || COMPANY REGISTRATION || COMPANY REGISTRATION IN INDORE || COMPANY REGISTRATION IN BHOPAL || COMPANY REGISTRATION IN PUNE || COMPANY REGISTRATION IN SURAT || COMPANY REGISTRATION IN MUMBAI || LLP REGISTRATION || LLP REGISTRATION IN INDORE || LLP REGISTRATION IN BHOPAL || LLP REGISTRATION IN PUNE || LLP REGISTRATION IN SURAT || LLP REGISTRATION IN MUMBAI